Million tons CO2 equivalent offset

Jobs

Female employees

Old Mutual representation on boards

Old Mutual Alternative Investments (OMAI) is committed to investing responsibly and achieving positive impact. Across different fund managers, investing in different asset classes in the private markets, OMAI implements an environmental, social and governance (ESG) and positive impact framework. OMAI focuses on the four key areas of climate change, decent work and economic growth, diversity and governance. Under these broad focus areas, our asset classes provide opportunity for positive impact through the themes of energy, carbon, social aspects, infrastructure, housing, education and governance. This introductory section provides the context of our thinking.

READ MORE

Climate change is arguably one of the greatest threats facing humankind and our planet. According to the Intergovernmental Panel on Climate Change, limiting warming to 1.5°C is possible, but would require unprecedented transitions in all aspects of society. Overall, the report shows there are clear benefits to keeping warming to 1.5°C, rather than the previously thought safe limit of 2°C. OMAI seeks to be part of the solution for a 1.5°C world. With implementation of the Task Force on Climate-related Financial Disclosures (TCFD) we are integrating climate risk into our investment decisions.

READ MORE

Work provides individuals with the ability to be in control of their own livelihood and financial circumstances. Productivity and meaningful work stimulate the mind, increases confidence and enhances social interactions. Meaningful work gives us a sense of pride, identity and personal achievement. Along with benefiting individuals, it also contributes to a healthy, dynamic economy and society, decreasing social ills of poverty and crime. Across Africa unemployment is constantly a concern, with youth skills shortages and unemployment being key challenges to solve. Our goal is to increase the number of jobs, provide meaningful work and enhance the skills of individuals across all our investments.

READ MORE

Gender equality is a fundamental human right and a necessary foundation for a peaceful, prosperous and sustainable world. While there has been progress towards gender equality and women’s empowerment, women and girls continue to suffer discrimination and violence in every part of the world. As professionals, we seek to drive the empowerment of women in our own business and in our portfolio companies.

Further to gender equality, OMAI supports the provision of inclusive work environments, where all people are welcomed and have the opportunity to fulfil their potential regardless of background.

READ MORE

Good governance lies at the heart of a sustainable business that delivers returns for all stakeholders, including shareholders, lenders, employees, suppliers and the communities in which we invest. As a responsible investor, OMAI maintains a continual focus on governance aspects in investment decision making and active stewardship of assets. OMAI applies good governance practices in all portfolio companies, across various African jurisdictions, with adherence to local governance-related laws and a reference to the King IV Report on good corporate governance.

READ MORE

We are committed to investing responsibly and have been on a steady and focused responsible investment journey.

READ MORE

The overall purpose of this report is to provide insights into our business and our investments beyond just financial returns. We have adopted various international ESG standards and frameworks, using the United Nations Sustainable Development Goals as the topline framework to drive positive outcomes. The report provides an OMAI wide and business unit level view of our ESG approach, our focus areas, ESG performance and what ESG topics we think are important to take note of. We seek to understand our footprint, assess what is possible to change in that footprint, then drive and measure that positive outcome.

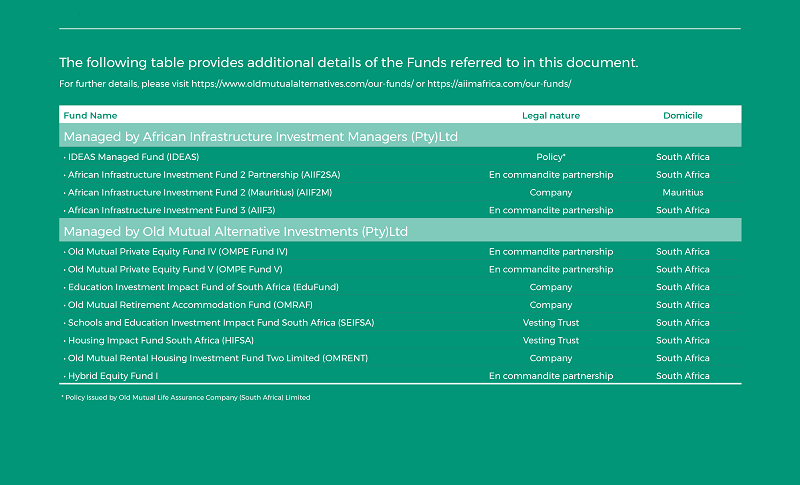

African Infrastructure Investment Managers (Pty) Ltd (Reg No 2000/001435/07) (FSP 4307) (“AIIM”) and Old Mutual Alternative Investments (Pty) Ltd (Reg No 2013/113833/07) (FSP 45255) (“OMAI”) are licensed financial services providers (“FSPs”), approved by the Financial Sector Conduct Authority (www.fsca.co.za) to provide advisory and/or intermediary services in terms of the Financial Advisory and Intermediary Services Act 37, 2002. AIIM and OMAI are subsidiaries within Old Mutual Investments (Pty) Ltd and ultimately owned by Old Mutual Limited. Further, OMAI includes the following capabilities:

While every effort has been made to ensure the accuracy of the information contained herein, the FSPs, its associated companies, its directors or employees provide no representation or warranty, express or implied, regarding the accuracy, completeness, or correctness of the Information. Any opinion expressed is intended for general information only and is subject to change at any time without notice. Applications to invest in any product referred to on this document may only be made on the basis of the offer documentation relating to that specific investment. Should you wish to discuss a possible investment or to review our offer documentation, please contact us. The information herein does not constitute an offer to sell or a solicitation of an offer to buy any securities, and no representations or warranties are given or implied. The information contained herein is subject to discussion, completion, and amendment and you should not solely rely on the contents hereof for investment or other decisions. The contents of this document do not constitute advice as defined in FAIS.

Investment portfolios are market-linked. Pooled products may be policy based, via a linked policy of insurance issued by Old Mutual Life Assurance Company (South Africa) Ltd, which is a registered Long-Term Insurer. Contractual rights and obligations of investors are set out in the relevant investor agreements and or mandates. Unlisted investments have short term to long term liquidity risks and there are no guarantees on the investment capital nor on performance.

It should be noted that investments within funds may not be readily marketable. It may therefore be difficult for an investor to withdraw from the fund or to obtain precise information about its value and the extent of the risks to which it is exposed. Market fluctuations and changes in exchange rates as well as taxation may affect the value, price, or income of investments and capital contributions. Since financial markets fluctuate, an investor may not recover the full amount invested. Past performance is not necessarily a guide to future investment performance.

For information about AIIM and OMAI’s privacy policy, please visit a www.aiimafrica.com and www.oldmutualalternatives.com.

This document is not an advertisement, and it is not intended for general public distribution. We outsource investment administration of our local funds to Curo Fund Services, 50% of which is owned by Old Mutual Investments (Pty) Ltd. All intra-group transactions are done on an arm’s length basis. Personal trading by staff is restricted to ensure that there is no conflict of interest.

All directors and those staff who are likely to have access to price sensitive and unpublished information in relation to the Old Mutual group are further restricted in their dealings in Old Mutual shares. All employees of OMAI and AIIM are remunerated with salaries and standard incentives as are usual when managing alternative asset classes. In addition to remuneration, unless disclosed to the client, no commission or incentives are paid by OMAI and AIIM to any persons other than its representatives. OMAI and AIIM have comprehensive crime and professional indemnity insurance which is part of the Old Mutual group cover.